More on Technology

Will Lockett

1 year ago

The world will be changed by this molten salt battery.

Four times the energy density and a fraction of lithium-cost ion's

As the globe abandons fossil fuels, batteries become more important. EVs, solar, wind, tidal, wave, and even local energy grids will use them. We need a battery revolution since our present batteries are big, expensive, and detrimental to the environment. A recent publication describes a battery that solves these problems. But will it be enough?

Sodium-sulfur molten salt battery. It has existed for a long time and uses molten salt as an electrolyte (read more about molten salt batteries here). These batteries are cheaper, safer, and more environmentally friendly because they use less eco-damaging materials, are non-toxic, and are non-flammable.

Previous molten salt batteries used aluminium-sulphur chemistries, which had a low energy density and required high temperatures to keep the salt liquid. This one uses a revolutionary sodium-sulphur chemistry and a room-temperature-melting salt, making it more useful, affordable, and eco-friendly. To investigate this, researchers constructed a button-cell prototype and tested it.

First, the battery was 1,017 mAh/g. This battery is four times as energy dense as high-density lithium-ion batteries (250 mAh/g).

No one knows how much this battery would cost. A more expensive molten-salt battery costs $15 per kWh. Current lithium-ion batteries cost $132/kWh. If this new molten salt battery costs the same as present cells, it will be 90% cheaper.

This room-temperature molten salt battery could be utilized in an EV. Cold-weather heaters just need a modest backup battery.

The ultimate EV battery? If used in a Tesla Model S, you could install four times the capacity with no weight gain, offering a 1,620-mile range. This huge battery pack would cost less than Tesla's. This battery would nearly perfect EVs.

Or would it?

The battery's capacity declined by 50% after 1,000 charge cycles. This means that our hypothetical Model S would suffer this decline after 1.6 million miles, but for more cheap vehicles that use smaller packs, this would be too short. This test cell wasn't supposed to last long, so this is shocking. Future versions of this cell could be modified to live longer.

This affordable and eco-friendly cell is best employed as a grid-storage battery for renewable energy. Its safety and affordable price outweigh its short lifespan. Because this battery is made of easily accessible materials, it may be utilized to boost grid-storage capacity without causing supply chain concerns or EV battery prices to skyrocket.

Researchers are designing a bigger pouch cell (like those in phones and laptops) for this purpose. The battery revolution we need could be near. Let’s just hope it isn’t too late.

Nikhil Vemu

1 year ago

7 Mac Tips You Never Knew You Needed

Unleash the power of the Option key ⌥

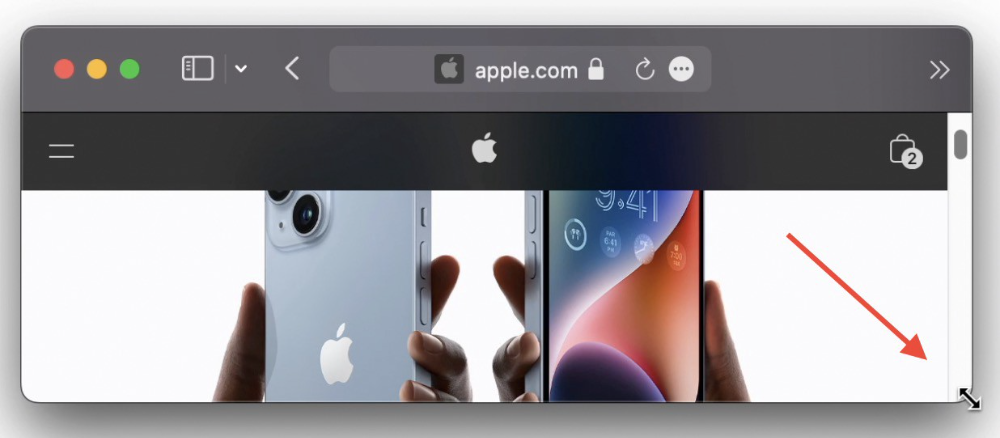

#1 Open a link in the Private tab first.

Previously, if I needed to open a Safari link in a private window, I would:

copied the URL with the right click command,

choose File > New Private Window to open a private window, and

clicked return after pasting the URL.

I've found a more straightforward way.

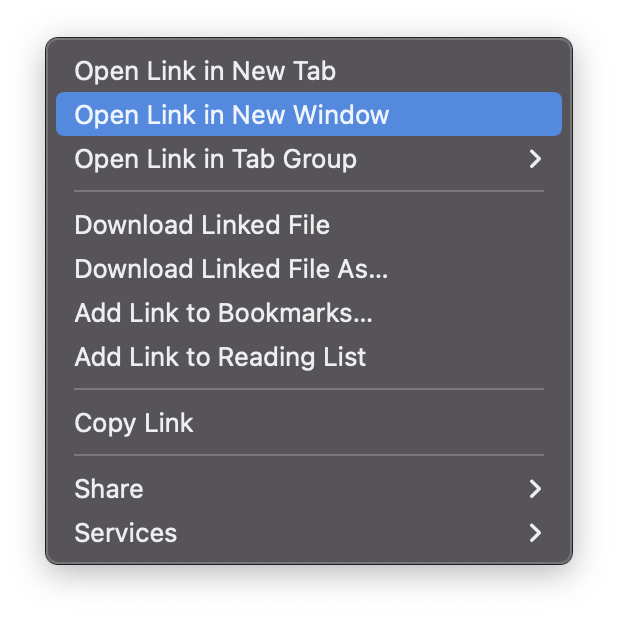

Right-clicking a link shows this, right?

Hold option (⌥) for:

Click Open Link in New Private Window while holding.

Finished!

#2. Instead of searching for specific characters, try this

You may use unicode for business or school. Most people Google them when they need them.

That is lengthy!

You can type some special characters just by pressing ⌥ and a key.

For instance

• ⌥+2 -> ™ (Trademark)

• ⌥+0 -> ° (Degree)

• ⌥+G -> © (Copyright)

• ⌥+= -> ≠ (Not equal to)

• ⌥+< -> ≤ (Less than or equal to)

• ⌥+> -> ≥ (Greater then or equal to)

• ⌥+/ -> ÷ (Different symbol for division)#3 Activate Do Not Disturb silently.

Do Not Disturb when sharing my screen is awkward for me (because people may think Im trying to hide some secret notifications).

Here's another method.

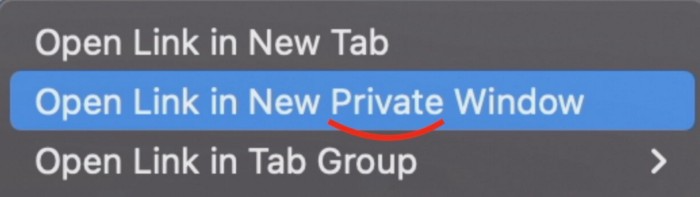

Hold ⌥ and click on Time (at the extreme right on the menu-bar).

Now, DND is activated (secretly!). To turn it off, do it again.

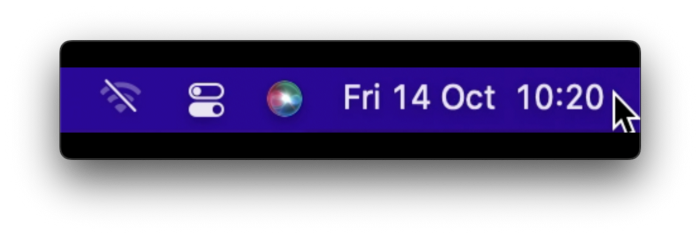

Note: This works only for DND focus.#4. Resize a window starting from its center

Although this is rarely useful, it is still a hidden trick.

When you resize a window, the opposite edge or corner is used as the pivot, right?

However, if you want to resize it with its center as the pivot, hold while doing so.

#5. Yes, Cut-Paste is available on Macs as well (though it is slightly different).

I call it copy-move rather than cut-paste. This is how it works.

Carry it out.

Choose a file (by clicking on it), then copy it (⌘+C).

Go to a new location on your Mac. Do you use ⌘+V to paste it? However, to move it, press ⌘+⌥+V.

This removes the file from its original location and copies it here. And it works exactly like cut-and-paste on Windows.

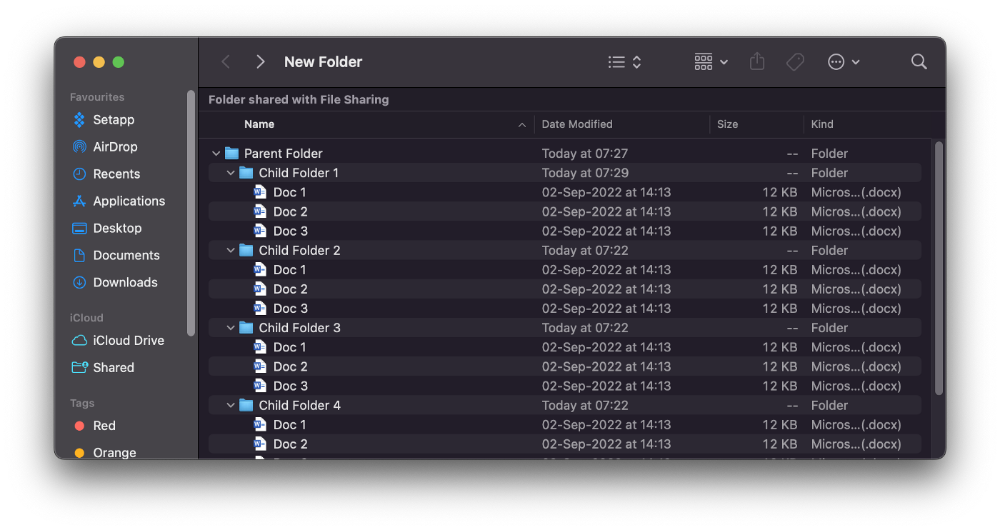

#6. Instantly expand all folders

Set your Mac's folders to List view.

Assume you have one folder with multiple subfolders, each of which contains multiple files. And you wanted to look at every single file that was over there.

How would you do?

You're used to clicking the ⌄ glyph near the folder and each subfolder to expand them all, right? Instead, hold down ⌥ while clicking ⌄ on the parent folder.

This is what happens next.

Everything expands.

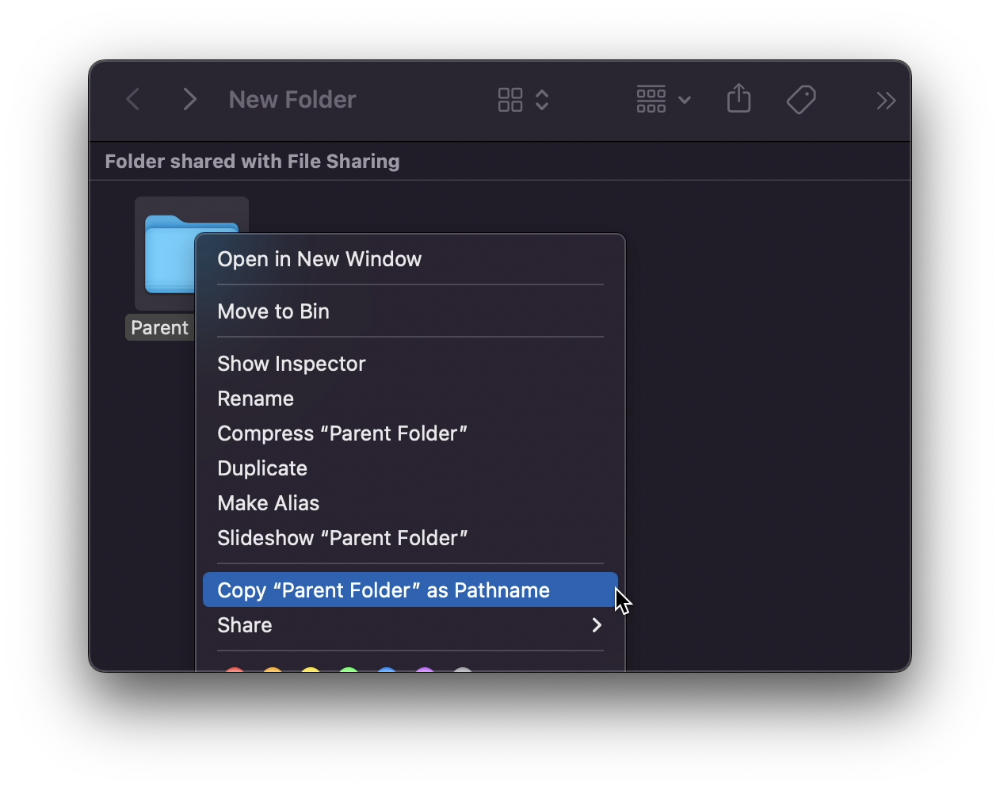

View/Copy a file's path as an added bonus

If you want to see the path of a file in Finder, select it and hold ⌥, and you'll see it at the bottom for a moment.

To copy its path, right-click on the folder and hold down ⌥ to see this

Click on Copy <"folder name"> as Pathname to do it.

#7 "Save As"

I was irritated by the lack of "Save As" in Pages when I first got a Mac (after 15 years of being a Windows guy).

It was necessary for me to save the file as a new file, in a different location, with a different name, or both.

Unfortunately, I couldn't do it on a Mac.

However, I recently discovered that it appears when you hold ⌥ when in the File menu.

Yay!

Frank Andrade

1 year ago

I discovered a bug that allowed me to use ChatGPT to successfully web scrape. Here's how it operates.

This method scrapes websites with ChatGPT (demo with Amazon and Twitter)

In a recent article, I demonstrated how to scrape websites using ChatGPT prompts like scrape website X using Python.

But that doesn’t always work.

After scraping dozens of websites with ChatGPT, I realized that simple prompts rarely work for web scraping.

Using ChatGPT and basic HTML, we can scrape any website.

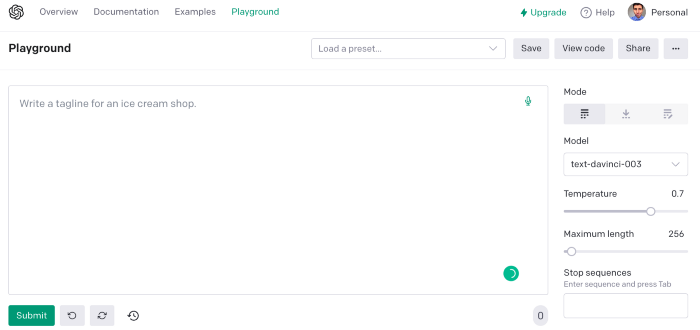

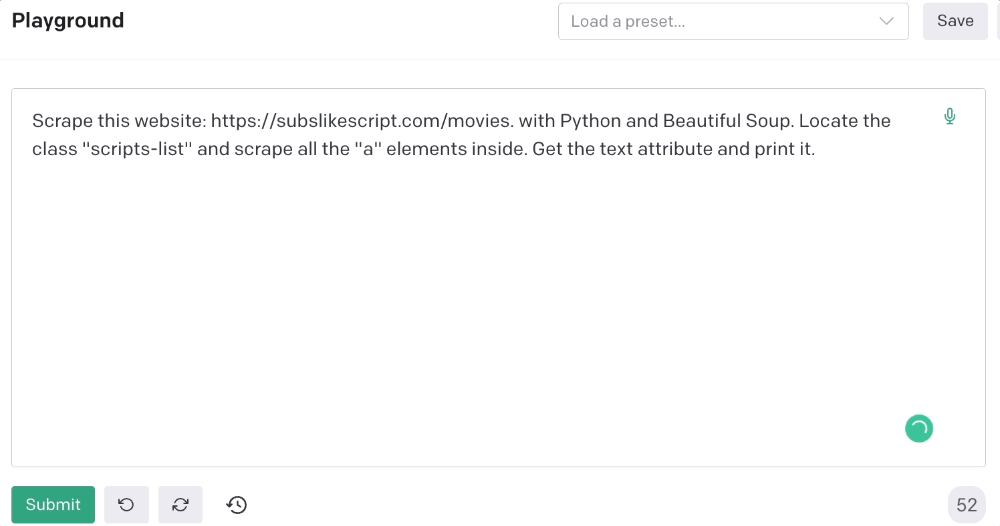

First things first, use ChatGPT's advanced version (Playground)

ChatGPT Playground's enhanced version is needed to scrape websites quickly. It generates code faster and has less constraints.

Here’s how it looks.

The classic ChatGPT display just allows you to type a prompt. Playground is more customizable and generates code faster than the basic version.

No more delays or restrictions.

In this tutorial, we'll write prompts underneath Playground.

How to Use ChatGPT to Scrape Any Website

To show you how to utilize ChatGPT to scrape any website, we'll use subslikescript, which lists movies.

Later in this post, I'll show you how to scrape Amazon and Twitter, but let's start easy.

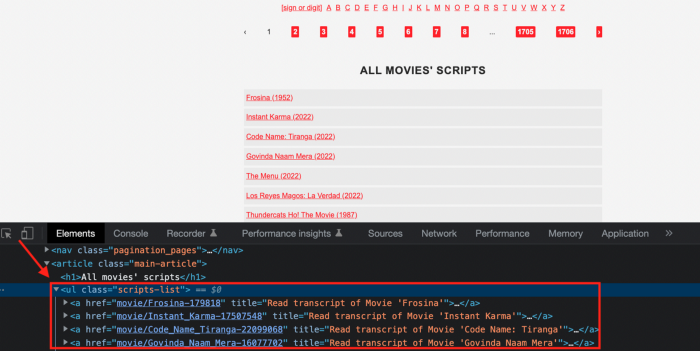

If we try a basic prompt like “scrape the movie titles on this website: https://subslikescript.com/movies” it won’t scrape anything. Here’s when we need some HTML knowledge to build the right prompt for ChatGPT.Let's scrape the above movie titles. First, check the webpage. Right-click any element and choose Inspect.

Then see below.

We identify the element to scrape (those in the red box). The data elements are ul, a, and scripts-list.

Here's the prompt for movie titles.

Scrape this website: https://subslikescript.com/movies with Python and Beautiful Soup. Locate the element with tag “ul” and class “scripts-list”. Scrape all the “a” elements inside. Get the text attribute and print it.

Code generated:

import requests

from bs4 import BeautifulSoup

page = requests.get('https://subslikescript.com/movies/')

soup = BeautifulSoup(page.content, 'html.parser')

scripts_list = soup.find(class_="scripts-list")

all_a_elements = scripts_list.find_all('a')

for element in all_a_elements:

print(element.get_text())It extracts movie titles successfully.

Let's scrape Amazon and Twitter.

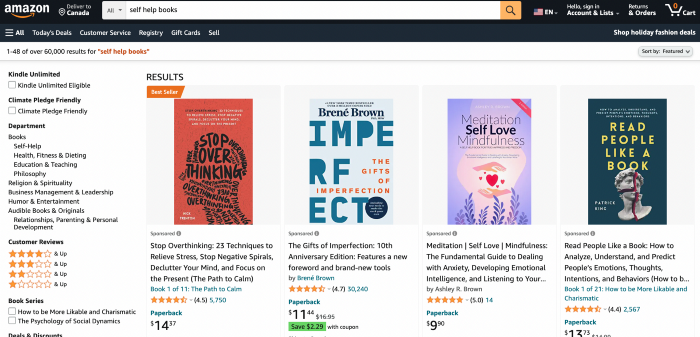

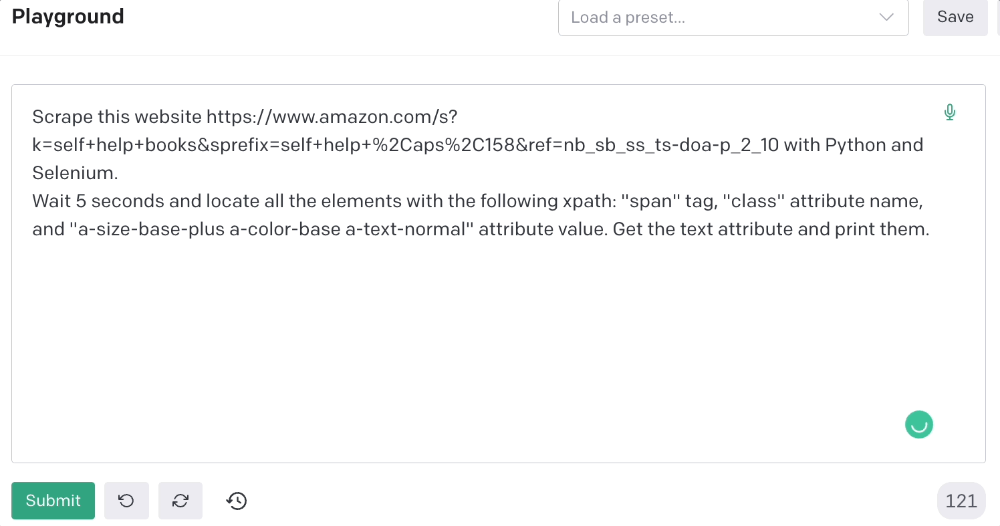

ChatGPT's Amazon scraping

Consider scraping Amazon for self-help books. First, copy the Amazon link for self-help books.

Here’s the link I got. Location-dependent connection. Use my link to replicate my results.

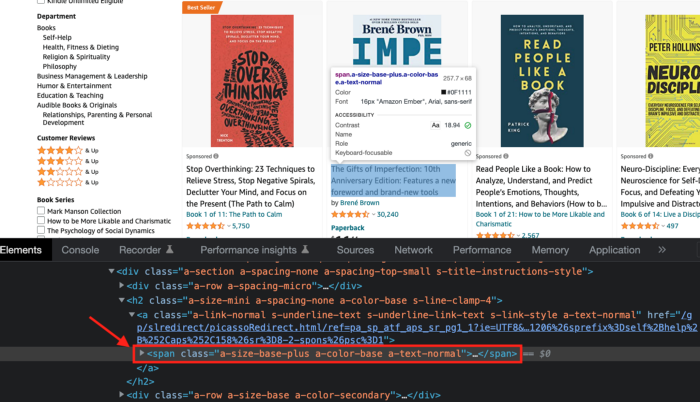

Now we'll check book titles. Here's our element.

If we want to extract the book titles, we need to use the tag name span, class attribute name and a-size-base-plus a-color-base a-text-normalattribute value.

This time I'll use Selenium. I'll add Selenium-specific commands like wait 5 seconds and generate an XPath.

Scrape this website https://www.amazon.com/s?k=self+help+books&sprefix=self+help+%2Caps%2C158&ref=nb_sb_ss_ts-doa-p_2_10 with Python and Selenium.

Wait 5 seconds and locate all the elements with the following xpath: “span” tag, “class” attribute name, and “a-size-base-plus a-color-base a-text-normal” attribute value. Get the text attribute and print them.

Code generated: (I only had to manually add the path where my chromedriver is located).

from selenium import webdriver

from selenium.webdriver.common.by import By

from time import sleep

#initialize webdriver

driver = webdriver.Chrome('<add path of your chromedriver>')

#navigate to the website

driver.get("https://www.amazon.com/s?k=self+help+books&sprefix=self+help+%2Caps%2C158&ref=nb_sb_ss_ts-doa-p_2_10")

#wait 5 seconds to let the page load

sleep(5)

#locate all the elements with the following xpath

elements = driver.find_elements(By.XPATH, '//span[@class="a-size-base-plus a-color-base a-text-normal"]')

#get the text attribute of each element and print it

for element in elements:

print(element.text)

#close the webdriver

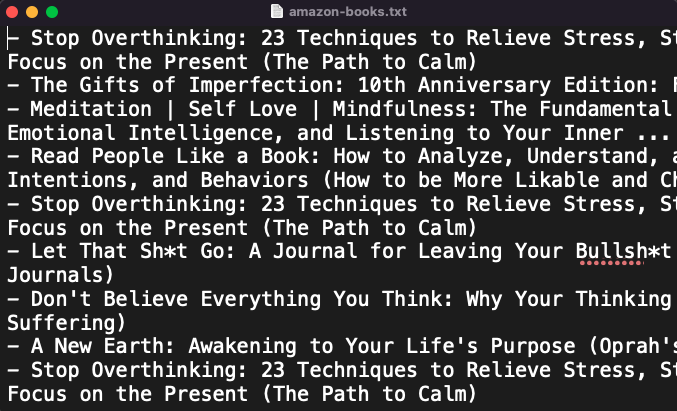

driver.close()It pulls Amazon book titles.

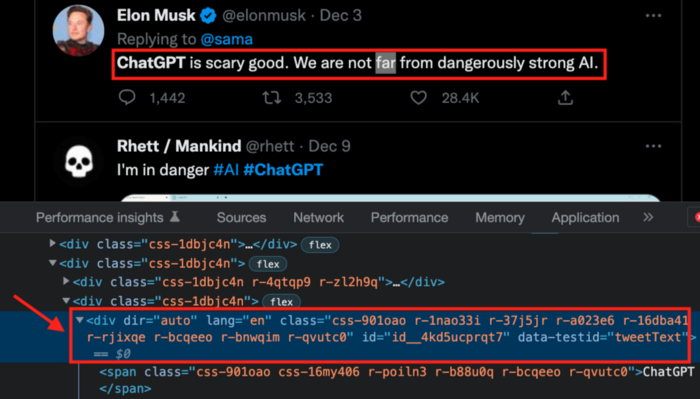

Utilizing ChatGPT to scrape Twitter

Say you wish to scrape ChatGPT tweets. Search Twitter for ChatGPT and copy the URL.

Here’s the link I got. We must check every tweet. Here's our element.

To extract a tweet, use the div tag and lang attribute.

Again, Selenium.

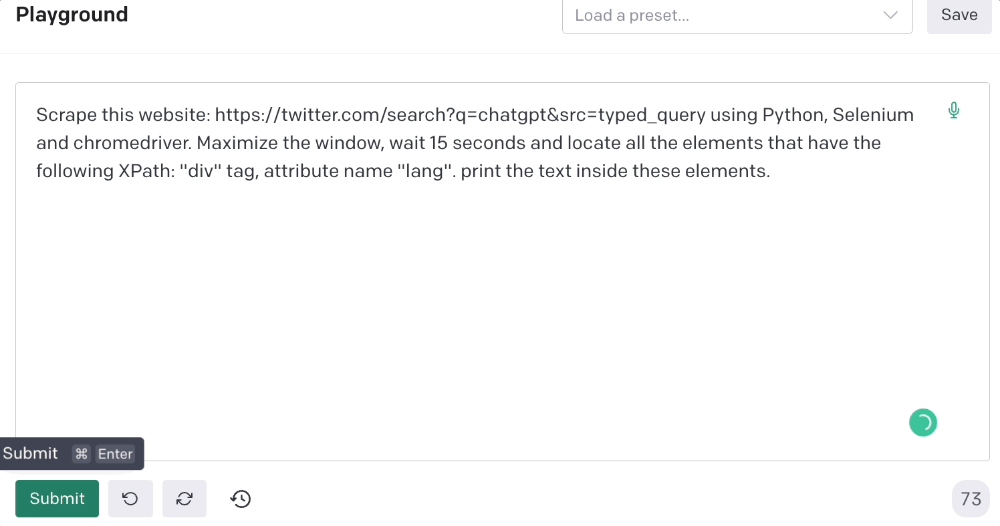

Scrape this website: https://twitter.com/search?q=chatgpt&src=typed_query using Python, Selenium and chromedriver.

Maximize the window, wait 15 seconds and locate all the elements that have the following XPath: “div” tag, attribute name “lang”. Print the text inside these elements.

Code generated: (again, I had to add the path where my chromedriver is located)

from selenium import webdriver

import time

driver = webdriver.Chrome("/Users/frankandrade/Downloads/chromedriver")

driver.maximize_window()

driver.get("https://twitter.com/search?q=chatgpt&src=typed_query")

time.sleep(15)

elements = driver.find_elements_by_xpath("//div[@lang]")

for element in elements:

print(element.text)

driver.quit()You'll get the first 2 or 3 tweets from a search. To scrape additional tweets, click X times.

Congratulations! You scraped websites without coding by using ChatGPT.

You might also like

Vitalik

2 years ago

Fairness alternatives to selling below market clearing prices (or community sentiment, or fun)

When a seller has a limited supply of an item in high (or uncertain and possibly high) demand, they frequently set a price far below what "the market will bear." As a result, the item sells out quickly, with lucky buyers being those who tried to buy first. This has happened in the Ethereum ecosystem, particularly with NFT sales and token sales/ICOs. But this phenomenon is much older; concerts and restaurants frequently make similar choices, resulting in fast sell-outs or long lines.

Why do sellers do this? Economists have long wondered. A seller should sell at the market-clearing price if the amount buyers are willing to buy exactly equals the amount the seller has to sell. If the seller is unsure of the market-clearing price, they should sell at auction and let the market decide. So, if you want to sell something below market value, don't do it. It will hurt your sales and it will hurt your customers. The competitions created by non-price-based allocation mechanisms can sometimes have negative externalities that harm third parties, as we will see.

However, the prevalence of below-market-clearing pricing suggests that sellers do it for good reason. And indeed, as decades of research into this topic has shown, there often are. So, is it possible to achieve the same goals with less unfairness, inefficiency, and harm?

Selling at below market-clearing prices has large inefficiencies and negative externalities

An item that is sold at market value or at an auction allows someone who really wants it to pay the high price or bid high in the auction. So, if a seller sells an item below market value, some people will get it and others won't. But the mechanism deciding who gets the item isn't random, and it's not always well correlated with participant desire. It's not always about being the fastest at clicking buttons. Sometimes it means waking up at 2 a.m. (but 11 p.m. or even 2 p.m. elsewhere). Sometimes it's just a "auction by other means" that's more chaotic, less efficient, and has far more negative externalities.

There are many examples of this in the Ethereum ecosystem. Let's start with the 2017 ICO craze. For example, an ICO project would set the price of the token and a hard maximum for how many tokens they are willing to sell, and the sale would start automatically at some point in time. The sale ends when the cap is reached.

So what? In practice, these sales often ended in 30 seconds or less. Everyone would start sending transactions in as soon as (or just before) the sale started, offering higher and higher fees to encourage miners to include their transaction first. Instead of the token seller receiving revenue, miners receive it, and the sale prices out all other applications on-chain.

The most expensive transaction in the BAT sale set a fee of 580,000 gwei, paying a fee of $6,600 to get included in the sale.

Many ICOs after that tried various strategies to avoid these gas price auctions; one ICO notably had a smart contract that checked the transaction's gasprice and rejected it if it exceeded 50 gwei. But that didn't solve the issue. Buyers hoping to game the system sent many transactions hoping one would get through. An auction by another name, clogging the chain even more.

ICOs have recently lost popularity, but NFTs and NFT sales have risen in popularity. But the NFT space didn't learn from 2017; they do fixed-quantity sales just like ICOs (eg. see the mint function on lines 97-108 of this contract here). So what?

That's not the worst; some NFT sales have caused gas price spikes of up to 2000 gwei.

High gas prices from users fighting to get in first by sending higher and higher transaction fees. An auction renamed, pricing out all other applications on-chain for 15 minutes.

So why do sellers sometimes sell below market price?

Selling below market value is nothing new, and many articles, papers, and podcasts have written (and sometimes bitterly complained) about the unwillingness to use auctions or set prices to market-clearing levels.

Many of the arguments are the same for both blockchain (NFTs and ICOs) and non-blockchain examples (popular restaurants and concerts). Fairness and the desire not to exclude the poor, lose fans or create tension by being perceived as greedy are major concerns. The 1986 paper by Kahneman, Knetsch, and Thaler explains how fairness and greed can influence these decisions. I recall that the desire to avoid perceptions of greed was also a major factor in discouraging the use of auction-like mechanisms in 2017.

Aside from fairness concerns, there is the argument that selling out and long lines create a sense of popularity and prestige, making the product more appealing to others. Long lines should have the same effect as high prices in a rational actor model, but this is not the case in reality. This applies to ICOs and NFTs as well as restaurants. Aside from increasing marketing value, some people find the game of grabbing a limited set of opportunities first before everyone else is quite entertaining.

But there are some blockchain-specific factors. One argument for selling ICO tokens below market value (and one that persuaded the OmiseGo team to adopt their capped sale strategy) is community dynamics. The first rule of community sentiment management is to encourage price increases. People are happy if they are "in the green." If the price drops below what the community members paid, they are unhappy and start calling you a scammer, possibly causing a social media cascade where everyone calls you a scammer.

This effect can only be avoided by pricing low enough that post-launch market prices will almost certainly be higher. But how do you do this without creating a rush for the gates that leads to an auction?

Interesting solutions

It's 2021. We have a blockchain. The blockchain is home to a powerful decentralized finance ecosystem, as well as a rapidly expanding set of non-financial tools. The blockchain also allows us to reset social norms. Where decades of economists yelling about "efficiency" failed, blockchains may be able to legitimize new uses of mechanism design. If we could use our more advanced tools to create an approach that more directly solves the problems, with fewer side effects, wouldn't that be better than fiddling with a coarse-grained one-dimensional strategy space of selling at market price versus below market price?

Begin with the goals. We'll try to cover ICOs, NFTs, and conference tickets (really a type of NFT) all at the same time.

1. Fairness: don't completely exclude low-income people from participation; give them a chance. The goal of token sales is to avoid high initial wealth concentration and have a larger and more diverse initial token holder community.

2. Don’t create races: Avoid situations where many people rush to do the same thing and only a few get in (this is the type of situation that leads to the horrible auctions-by-another-name that we saw above).

3. Don't require precise market knowledge: the mechanism should work even if the seller has no idea how much demand exists.

4. Fun: The process of participating in the sale should be fun and game-like, but not frustrating.

5. Give buyers positive expected returns: in the case of a token (or an NFT), buyers should expect price increases rather than decreases. This requires selling below market value.

Let's start with (1). From Ethereum's perspective, there is a simple solution. Use a tool designed for the job: proof of personhood protocols! Here's one quick idea:

Mechanism 1 Each participant (verified by ID) can buy up to ‘’X’’ tokens at price P, with the option to buy more at an auction.

With the per-person mechanism, buyers can get positive expected returns for the portion sold through the per-person mechanism, and the auction part does not require sellers to understand demand levels. Is it race-free? The number of participants buying through the per-person pool appears to be high. But what if the per-person pool isn't big enough to accommodate everyone?

Make the per-person allocation amount dynamic.

Mechanism 2 Each participant can deposit up to X tokens into a smart contract to declare interest. Last but not least, each buyer receives min(X, N / buyers) tokens, where N is the total sold through the per-person pool (some other amount can also be sold by auction). The buyer gets their deposit back if it exceeds the amount needed to buy their allocation.

No longer is there a race condition based on the number of buyers per person. No matter how high the demand, it's always better to join sooner rather than later.

Here's another idea if you like clever game mechanics with fancy quadratic formulas.

Mechanism 3 Each participant can buy X units at a price P X 2 up to a maximum of C tokens per buyer. C starts low and gradually increases until enough units are sold.

The quantity allocated to each buyer is theoretically optimal, though post-sale transfers will degrade this optimality over time. Mechanisms 2 and 3 appear to meet all of the above objectives. They're not perfect, but they're good starting points.

One more issue. For fixed and limited supply NFTs, the equilibrium purchased quantity per participant may be fractional (in mechanism 2, number of buyers > N, and in mechanism 3, setting C = 1 may already lead to over-subscription). With fractional sales, you can offer lottery tickets: if there are N items available, you have a chance of N/number of buyers of getting the item, otherwise you get a refund. For a conference, groups could bundle their lottery tickets to guarantee a win or a loss. The certainty of getting the item can be auctioned.

The bottom tier of "sponsorships" can be used to sell conference tickets at market rate. You may end up with a sponsor board full of people's faces, but is that okay? After all, John Lilic was on EthCC's sponsor board!

Simply put, if you want to be reliably fair to people, you need an input that explicitly measures people. Authentication protocols do this (and if desired can be combined with zero knowledge proofs to ensure privacy). So we should combine the efficiency of market and auction-based pricing with the equality of proof of personhood mechanics.

Answers to possible questions

Q: Won't people who don't care about your project buy the item and immediately resell it?

A: Not at first. Meta-games take time to appear in practice. If they do, making them untradeable for a while may help mitigate the damage. Using your face to claim that your previous account was hacked and that your identity, including everything in it, should be moved to another account works because proof-of-personhood identities are untradeable.

Q: What if I want to make my item available to a specific community?

A: Instead of ID, use proof of participation tokens linked to community events. Another option, also serving egalitarian and gamification purposes, is to encrypt items within publicly available puzzle solutions.

Q: How do we know they'll accept? Strange new mechanisms have previously been resisted.

A: Having economists write screeds about how they "should" accept a new mechanism that they find strange is difficult (or even "equity"). However, abrupt changes in context effectively reset people's expectations. So the blockchain space is the best place to try this. You could wait for the "metaverse", but it's possible that the best version will run on Ethereum anyway, so start now.

Nir Zicherman

1 year ago

The Great Organizational Conundrum

Only two of the following three options can be achieved: consistency, availability, and partition tolerance

Someone told me that growing from 30 to 60 is the biggest adjustment for a team or business.

I remember thinking, That's random. Each company is unique. I've seen teams of all types confront the same issues during development periods. With new enterprises starting every year, we should be better at navigating growing difficulties.

As a team grows, its processes and systems break down, requiring reorganization or declining results. Why always? Why isn't there a perfect scaling model? Why hasn't that been found?

The Three Things Productive Organizations Must Have

Any company should be efficient and productive. Three items are needed:

First, it must verify that no two team members have conflicting information about the roadmap, strategy, or any input that could affect execution. Teamwork is required.

Second, it must ensure that everyone can receive the information they need from everyone else quickly, especially as teams become more specialized (an inevitability in a developing organization). It requires everyone's accessibility.

Third, it must ensure that the organization can operate efficiently even if a piece is unavailable. It's partition-tolerant.

From my experience with the many teams I've been on, invested in, or advised, achieving all three is nearly impossible. Why a perfect organization model cannot exist is clear after analysis.

The CAP Theorem: What is it?

Eric Brewer of Berkeley discovered the CAP Theorem, which argues that a distributed data storage should have three benefits. One can only have two at once.

The three benefits are consistency, availability, and partition tolerance, which implies that even if part of the system is offline, the remainder continues to work.

This notion is usually applied to computer science, but I've realized it's also true for human organizations. In a post-COVID world, many organizations are hiring non-co-located staff as they grow. CAP Theorem is more important than ever. Growing teams sometimes think they can develop ways to bypass this law, dooming themselves to a less-than-optimal team dynamic. They should adopt CAP to maximize productivity.

Path 1: Consistency and availability equal no tolerance for partitions

Let's imagine you want your team to always be in sync (i.e., for someone to be the source of truth for the latest information) and to be able to share information with each other. Only division into domains will do.

Numerous developing organizations do this, especially after the early stage (say, 30 people) when everyone may wear many hats and be aware of all the moving elements. After a certain point, it's tougher to keep generalists aligned than to divide them into specialized tasks.

In a specialized, segmented team, leaders optimize consistency and availability (i.e. every function is up-to-speed on the latest strategy, no one is out of sync, and everyone is able to unblock and inform everyone else).

Partition tolerance suffers. If any component of the organization breaks down (someone goes on vacation, quits, underperforms, or Gmail or Slack goes down), productivity stops. There's no way to give the team stability, availability, and smooth operation during a hiccup.

Path 2: Partition Tolerance and Availability = No Consistency

Some businesses avoid relying too heavily on any one person or sub-team by maximizing availability and partition tolerance (the organization continues to function as a whole even if particular components fail). Only redundancy can do that. Instead of specializing each member, the team spreads expertise so people can work in parallel. I switched from Path 1 to Path 2 because I realized too much reliance on one person is risky.

What happens after redundancy? Unreliable. The more people may run independently and in parallel, the less anyone can be the truth. Lack of alignment or updated information can lead to people executing slightly different strategies. So, resources are squandered on the wrong work.

Path 3: Partition and Consistency "Tolerance" equates to "absence"

The third, least-used path stresses partition tolerance and consistency (meaning answers are always correct and up-to-date). In this organizational style, it's most critical to maintain the system operating and keep everyone aligned. No one is allowed to read anything without an assurance that it's up-to-date (i.e. there’s no availability).

Always short-lived. In my experience, a business that prioritizes quality and scalability over speedy information transmission can get bogged down in heavy processes that hinder production. Large-scale, this is unsustainable.

Accepting CAP

When two puzzle pieces fit, the third won't. I've watched developing teams try to tackle these difficulties, only to find, as their ancestors did, that they can never be entirely solved. Idealized solutions fail in reality, causing lost effort, confusion, and lower production.

As teams develop and change, they should embrace CAP, acknowledge there is a limit to productivity in a scaling business, and choose the best two-out-of-three path.

Tim Denning

1 year ago

Read These Books on Personal Finance to Boost Your Net Worth

And retire sooner.

Books can make you filthy rich.

If you apply what you learn. In 2011, I was broke and had broken dreams.

Someone suggested I read finance books. One Up On Wall Street was his first recommendation.

Finance books were my crack.

I've read every money book since then. Some are good, but most stink.

These books will make you rich.

The Almanack of Naval Ravikant by Eric Jorgenson

This isn't a cliche book.

This book was inspired by a How to Get Rich tweet thread.

It’s one of the best tweets I’ve ever read.

Naval thinks differently. He nukes ordinary ideas. I've never heard better money advice.

Eric Jorgenson wrote a book about this tweet thread with Navals permission. A must-read, easy-to-digest book.

Best quote

Seek wealth, not money or status. Wealth is having assets that earn while you sleep. Money is how we transfer time and wealth. Status is your place in the social hierarchy — Naval

Morgan Housel's The Psychology of Money

Many finance books advise investing like a dunce.

They almost all peddle the buy an index fund BS. Different book.

It's about money-making psychology. Because any fool can get rich and drunk on their ego. Few can consistently make money.

Each chapter is short. A single-page chapter breaks all book publishing rules.

Best quote

Spending money to show people how much money you have is the fastest way to have less money — Morgan Housel

J.L. Collins' The Simple Path to Wealth

Most of the best money books were written by bloggers.

JL Collins blogs. This easy-to-read book was written for his daughter.

This book popularized the phrase F You Money. With enough money in your bank account and investment portfolio, you can say F You more.

A bad boss is an example. You can leave instead of enduring his wrath.

You can then sit at home and look for another job while financially secure. JL says its mind-freedom is powerful.

Best phrasing

You own the things you own and they in turn own you — J.L. Collins

Tony Robbins' Unshakeable

I like Tony. This book makes me sweaty.

Tony interviews the world's top financiers. He interviews people who rarely do so.

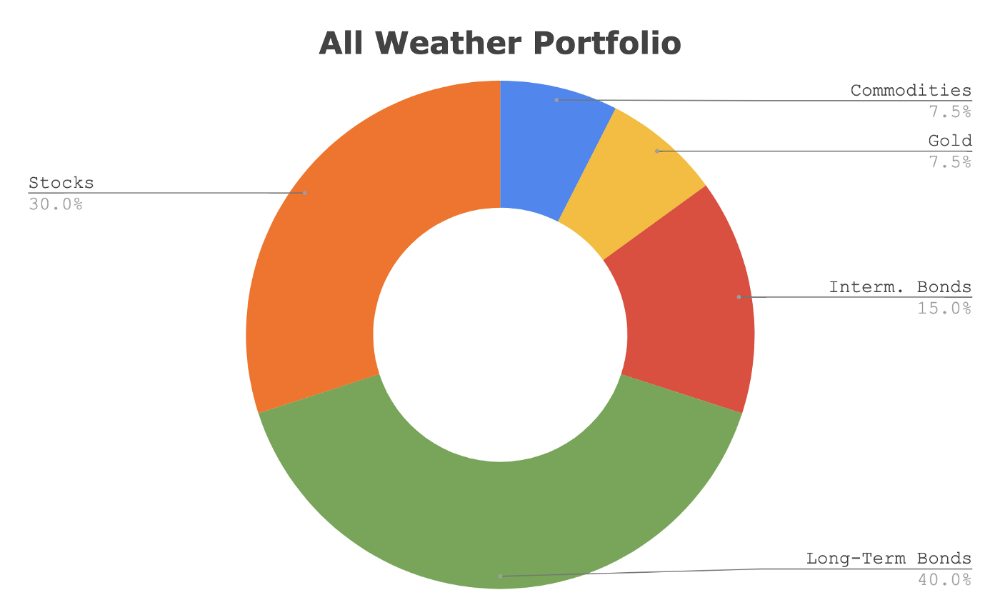

This book taught me all-weather portfolio. It's a way to invest in different asset classes in good, bad, recession, or depression times.

Look at it:

Investing isn’t about buying one big winner — that’s gambling. It’s about investing in a diversified portfolio of assets.

Best phrasing

The best opportunities come in times of maximum pessimism — Tony Robbins

Ben Graham's The Intelligent Investor

This book helped me distinguish between a spectator and an investor.

Spectators are those who shout that crypto, NFTs, or XYZ platform will die.

Tourists. They want attention and to say "I told you so." They make short-term and long-term predictions like fortunetellers. LOL. Idiots.

Benjamin Graham teaches smart investing. You'll buy a long-term asset. To be confident in recessions, use dollar-cost averaging.

Best phrasing

Those who do not remember the past are condemned to repeat it. — Benjamin Graham

The Napoleon Hill book Think and Grow Rich

This classic book introduced positive thinking to modern self-help.

Lazy pessimists can't become rich. No way.

Napoleon said, "Thoughts create reality."

No surprise that he discusses obsession and focus in this book. They are the fastest ways to make more money to invest in time and wealth-protecting assets.

Best phrasing

The starting point of all achievement is DESIRE. Keep this constantly in mind. Weak desire brings weak results, just as a small fire makes a small amount of heat — Napoleon Hill

Ramit Sethi's book I Will Teach You To Be Rich

This book is mostly good. The part about credit cards is trash.

Avoid credit card temptations. I don't care about their airline points.

This book teaches you to master money basics (that many people mess up) then automate it so your monkey brain doesn't ruin your financial future.

The book includes great negotiation tactics to help you make more money in less time.

Best quote

The 85 Percent Solution: Getting started is more important than becoming an expert — Ramit Sethi

David Bach's The Automatic Millionaire

You've probably met a six- or seven-figure earner who's broke. All their money goes to useless things like cars.

Money isn't as essential as what you do with it. David teaches how to automate your earnings for more money.

Compounding works once investing is automated. So you get rich.

His strategy eliminates luck and (almost) guarantees millionaire status.

Best phrasing

Every time you earn one dollar, make sure to pay yourself first — David Bach

Thomas J. Stanley's The Millionaire Next Door

Thomas defies the definition of rich.

He spends much of the book highlighting millionaire traits he's studied.

Rich people are quiet, so you wouldn't know they're wealthy. They don't earn much money or drive a BMW.

Thomas will give you the math to get started.

Best phrasing

I am not impressed with what people own. But I’m impressed with what they achieve. I’m proud to be a physician. Always strive to be the best in your field…. Don’t chase money. If you are the best in your field, money will find you. — Thomas J. Stanley

by Bill Perkins "Die With Zero"

Let’s end with one last book.

Bill's book angered many people. He says we spend too much time saving for retirement and die rich. That bank money is lost time.

Your grandkids could use the money. When children inherit money, they become lazy, entitled a-holes.

Bill wants us to spend our money on life-enhancing experiences. Stop saving money like monopoly monkeys.

Best phrasing

You should be focusing on maximizing your life enjoyment rather than on maximizing your wealth. Those are two very different goals. Money is just a means to an end: Having money helps you to achieve the more important goal of enjoying your life. But trying to maximize money actually gets in the way of achieving the more important goal — Bill Perkins